The Senate announced yesterday the suspension of all legislative actions on the contentious tax reform bills. The decision comes amid mounting pressure from various stakeholders, particularly Northern governors and lawmakers who have voiced strong opposition to the proposed changes in the country’s tax administration system.

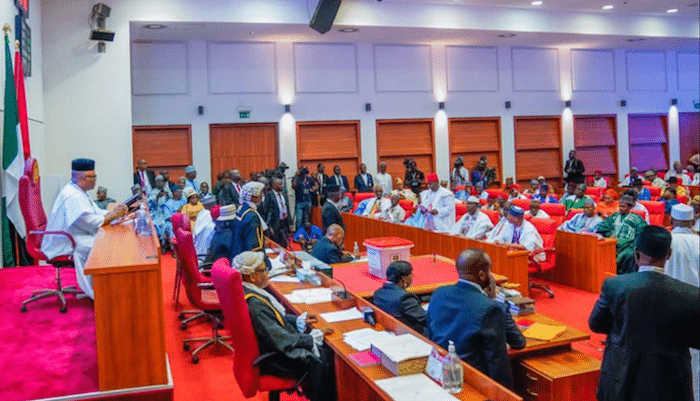

During Wednesday’s plenary session, Deputy Senate President Jibrin Barau revealed that the upper chamber has instructed its Committee on Finance to halt all public hearings on the bills pending the resolution of widespread concerns. The suspension affects several crucial pieces of legislation, including the Joint Revenue Board of Nigeria (Establishment) Bill, 2024, the Nigeria Revenue Service (Establishment) Bill, 2024, and the Nigeria Tax Bill, 2024.

The controversy primarily centers around the proposed changes to the value-added tax (VAT) distribution system, which has become a focal point of regional discord. Northern legislators, led by Senator Shehu Buba of Bauchi South, have expressed particular concern about the “derivation” formula contained within the bills. In a recent interview with the BBC Hausa Service, Senator Buba argued that the proposed changes would disproportionately impact Northern states, highlighting the deep regional divisions the legislation has exposed.

In response to the escalating situation, the Senate has established a special committee tasked with engaging the executive branch to find common ground. This move represents a significant shift in the legislative body’s approach to the reform package, which has faced increasing opposition since its introduction to the National Assembly. The committee’s membership includes prominent senators from across the country’s geopolitical zones, among them Orji Kalu, Seriake Dickson, and Adeola Olamilekan, reflecting the national importance of the issue.

The suspension of the bills follows a direct intervention from the National Economic Council, which had previously requested the withdrawal of the legislation for further consultations. This unprecedented step highlights the serious concerns about the potential impact of the reforms on Nigeria’s complex federal structure and fiscal arrangements.

Deputy Senate President Barau emphasized the upper chamber’s commitment to finding a resolution through dialogue and consensus. The Senate of the Federal Republic of Nigeria, like similar bodies globally, serves as a stabilising force in times of difficulty or disagreement,” he stated during the plenary session. Through dialogue and consensus, the Senate has consistently provided solutions to national challenges since 1999.

The controversy comes at a particularly challenging time for Nigeria, as the country grapples with multiple economic and security challenges. The Senate leadership acknowledged these existing difficulties, noting that the tax reform dispute should not further complicate the nation’s current situation. In recognition of this, the special committee is scheduled to meet with the Attorney General of the Federation today to begin addressing the contentious aspects of the legislation.

The suspension of the tax reform bills represents a crucial moment in Nigeria’s ongoing efforts to modernize its tax administration system. The proposed reforms were initially designed to streamline the country’s tax collection processes and enhance revenue generation capabilities. However, the strong regional opposition, particularly from Northern governors who have labeled the bills as “anti-democracy,” has forced a reassessment of the approach to these changes.

The involvement of the judiciary branch in the resolution process adds another layer of complexity to the situation. The President has instructed the Ministry of Justice to engage with the judiciary, suggesting that the constitutional implications of the proposed reforms may require careful legal scrutiny. This multi-branch approach to resolving the crisis demonstrates the far-reaching implications of the proposed tax reforms for Nigeria’s federal structure.

The special committee formed by the Senate includes a broad cross-section of political leadership, with representatives from both major parties and all regions of the country. Notable members include Adamu Ailero from Kebbi Central, Titus Zam from Benue South, and Adetokunbo Abiru from Lagos East, indicating the Senate’s commitment to finding a solution that addresses concerns from all parts of the nation.

As Nigeria continues to navigate this complex legislative challenge, the outcome of these discussions will likely have lasting implications for the country’s fiscal federalism and tax administration system. The Senate’s decision to suspend action on the bills while seeking a consensual approach demonstrates both the complexity of the issues at hand and the importance of maintaining national unity in the face of significant policy changes.

The developments around these tax reform bills highlight the delicate balance required in implementing major fiscal reforms in a diverse federal system like Nigeria’s. As discussions continue between the legislative and executive branches, with input from the judiciary, the resolution of this crisis could set important precedents for how similar challenges are addressed in the future.