The rise of loan apps has revolutionized the way people access credit, offering quick and convenient solutions to financial needs. However, the convenience and accessibility of these apps often mask a host of dangers that can lead to serious financial consequences. This article delves into the potential pitfalls of borrowing money from loan apps in Nigeria, shedding light on the risks involved and providing guidance on how to avoid them.

1. Exorbitant Interest Rates and Hidden Fees

One of the most significant dangers of loan apps is the exorbitant interest rates and hidden fees they often impose. These charges can quickly escalate, making it difficult for borrowers to repay their loans on time. This can lead to a cycle of debt, where borrowers find themselves taking out new loans to cover the interest and fees on existing ones.

2. Predatory Lending Practices

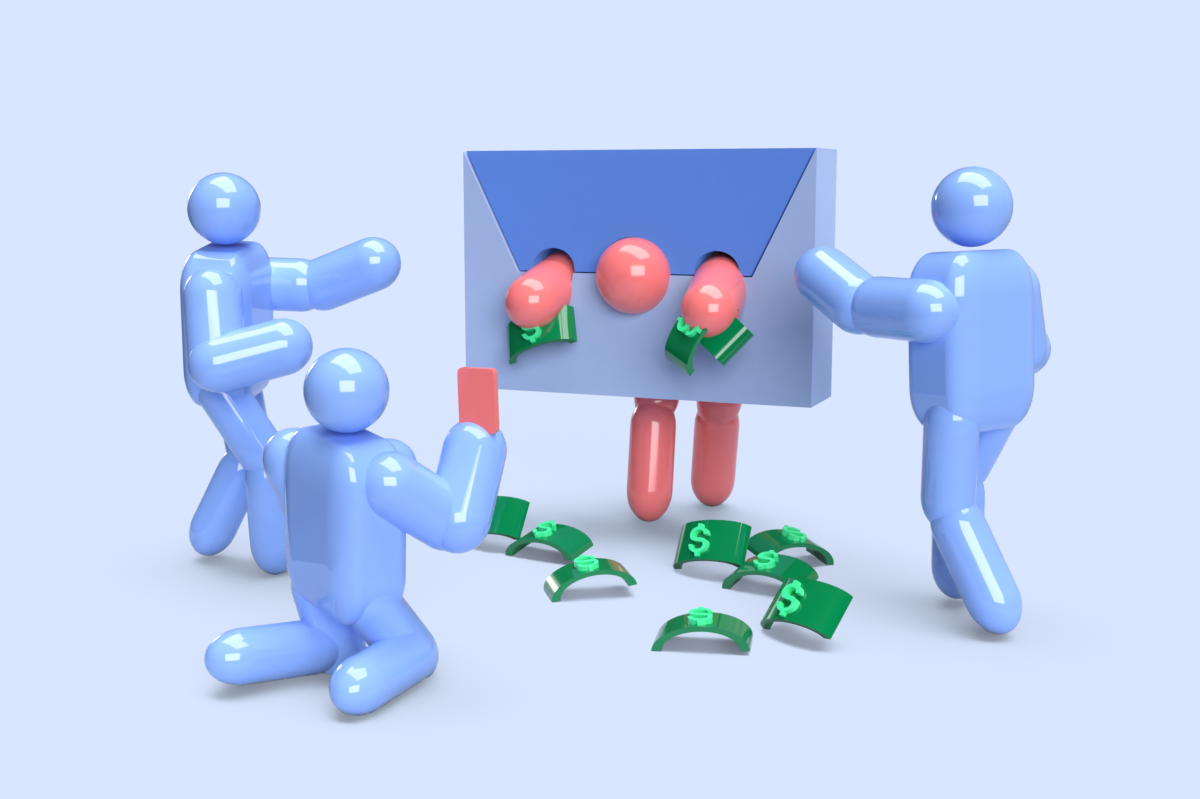

Some loan apps engage in predatory lending practices, targeting vulnerable individuals and charging excessive interest rates. These apps may also employ aggressive tactics to collect payments, including harassment, threats, and even blackmail. Such practices can have a devastating impact on borrowers’ mental health and financial well-being.

3. Privacy Concerns and Data Breaches

Loan apps often require borrowers to provide personal and financial information, which can be vulnerable to data breaches. This information can be misused for identity theft, fraud, or other malicious purposes. It’s essential to be cautious about the information you share with loan apps and ensure they have adequate security measures in place to protect your data.

4. Debt Traps and Financial Ruin

The ease of obtaining loans through apps can lead to impulsive borrowing and excessive debt. Borrowers may find themselves taking out multiple loans to cover their expenses, ultimately falling into a debt trap that can be difficult to escape. This can have serious financial consequences, including bankruptcy, foreclosure, and damage to credit scores.

5. Limited Regulatory Oversight

The unregulated nature of the loan app industry in Nigeria poses significant risks for borrowers. Many loan apps operate outside the purview of regulatory authorities, making it difficult for consumers to seek redress in case of disputes or unfair practices. This lack of oversight can create a breeding ground for unscrupulous lenders.

6. The Psychological Impact of Debt

The stress and anxiety associated with debt can have a severe impact on mental health. The constant worry about repayment, the fear of financial ruin, and the shame of borrowing can lead to depression, anxiety, and even suicidal thoughts. It’s important to recognize the psychological toll that debt can take and seek help if you’re struggling.

7. Tips for Safe Borrowing

While the dangers of loan apps are real, it’s not impossible to borrow responsibly. Here are some tips to help you avoid the pitfalls and make informed decisions:

- Research and compare: Before choosing a loan app, research different options and compare interest rates, fees, and terms.

- Read the fine print: Carefully review the terms and conditions of the loan agreement to understand the full cost of borrowing.

- Avoid predatory lenders: Be wary of loan apps that offer excessively high interest rates, hidden fees, or aggressive collection tactics.

- Limit borrowing: Only borrow what you can afford to repay, and avoid taking on multiple loans at once.

- Create a budget: Develop a budget to track your income and expenses and ensure you can afford to make your loan payments.

- Consider alternative options: Explore other options for financing, such as personal loans from banks or credit unions, which may offer more favorable terms.

- Seek professional help: If you’re struggling with debt, seek advice from a financial counselor or debt management agency.

By understanding the risks associated with loan apps and taking precautions, you can make informed decisions and avoid falling into a debt trap. Remember, borrowing responsibly is key to financial well-being.